child tax credit portal update dependents

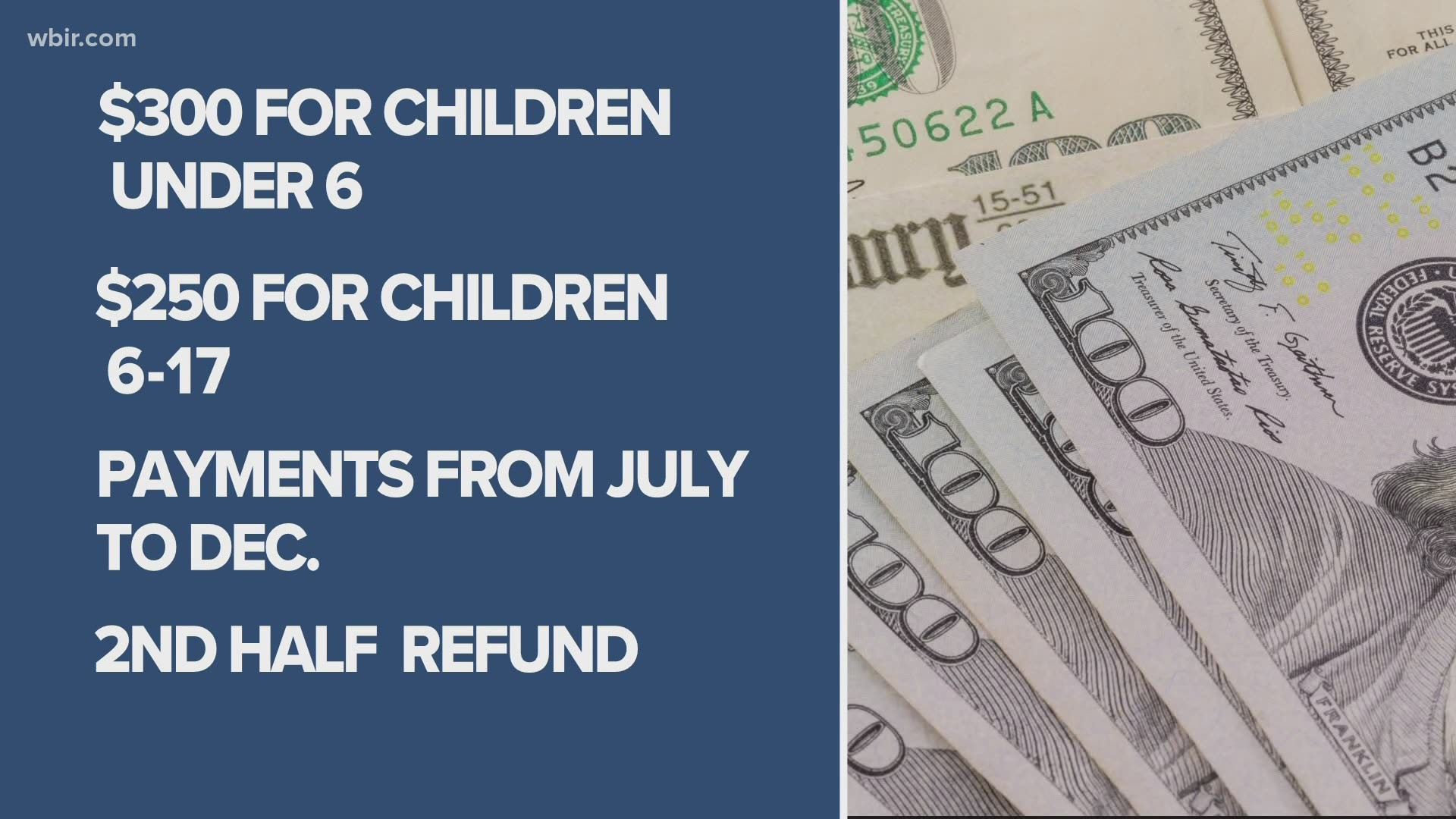

Yes the guidelines provide a credit for the child care expenses necessary to allow a parent to work or for activities related to employment training see ORC 31190501afor the child in the child support order to the parent that is paying for the child care. 3000 per child 6-17 years old.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Want advance payments of the Child Tax Credit or I.

. These credits can be claimed by. If you were eligible to receive advance Child Tax Credit payments based on your 2020 tax return or 2019 tax return including information you entered into the Non-Filer tool for Economic Impact Payments on IRSgov in 2020 or the Child Tax Credit Non-filer Sign-up Tool in 2021 you generally received those payments automatically without. Given the concerns about some of these letters it seems more important to move cautiously and review bank records as well as whats available on the IRS child tax credit portal.

Children and Other Dependents on line 14f or. Yes even if you dont file taxes by the deadline or dont owe taxes April 18 is not the last chance to claim child tax credits or the earned income tax credit. What if I.

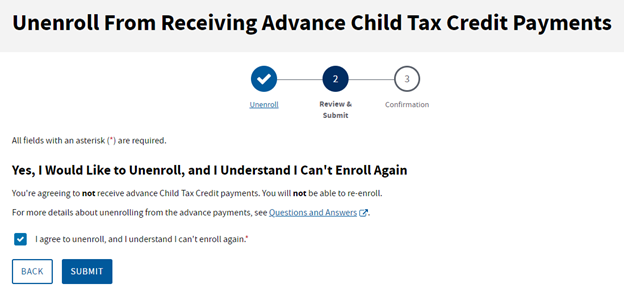

The Child Tax Credit Update Portal allows people to unenroll from. Keep in mind that the Eligibility Assistant tool and Child Tax Credit Update Portal. To update or add a bank account see details later in this guide in the Use the Child Tax Credit Update Portal to manage direct deposit accounts for your advance payments section.

Parents of dependents ages 18 to 24 will get up to 500 when they file their taxes. While the child tax credit was enacted in 1997 the American Rescue Plan Act of 2021 changed it for the 2021 tax year in several. The child tax credit was created to help parents offset the cost of raising a family.

Take an extra. Others who dont want to wait may need to review their own records and check their specific information at the IRS Child Tax Credit Update Portal. All working families will get the full credit if they make up to 150000 for a couple or 112500 for a family with a single.

Its available to parents with qualifying children which can include certain dependents who arent your biological children. 3600 per child under 6 years old. Including a premium tax credit or cost-sharing reduction received by the.

![]()

Child Tax Credit Update Irs Launches Two Online Portals

Child Tax Credit Deadline Missed Here S What Parents Need To Know

Here S What You Need To Know About The Monthly Child Tax Credit Payments New Hampshire Bulletin

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Update Child Tax Credit Portal Now If Your Income Changed Forbes Advisor

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Child Tax Credit Schedule 8812 H R Block

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

/cloudfront-us-east-1.images.arcpublishing.com/gray/NTFOD5O45ND3FNB4WAUKZX5ZHE.jpg)

Irs Says Portal Now Open To Update Banking Info For Child Tax Credit Payments

Didn T Get Your Child Tax Credit Here S How To Track It Down Gobankingrates

Child Tax Credit You Can Opt Out Of Monthly Payment Soon Abc10 Com

No Lines No Waiting You Don T Have To Wait For The Irs Refund At The End Of February Get An Advance Up To 3000 Wh Filing Taxes Accounting Services Tax Time

Irs Child Tax Credit Payments Start July 15

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

Child Tax Credit Dates 2021 Latest August 30 Deadline To Opt Out Of September Payments As Parents Flock To Irs Portal

White House Unveils Updated Child Tax Credit Portal For Eligible Families

Irs Launches Two New Online Tools For Monthly Child Tax Credit Payments The Washington Post